boulder co sales tax vehicle

The Boulder sales tax rate is. This tax must be collected in addition to any applicable city and state taxes.

Please note that we do not handle drivers license services.

. Weight of the vehicle 3. A weight slip will be required for out-of-state vehicles if the empty weight is over 4500 pounds and is not listed on the title. Standard Sales Tax Receipt for Vehicle Sales DR 0024 Sales and Use Tax on Vehicles Sales.

In general retailers including auto dealers are required. Real property tax on median home. The cost of a license plate is based on.

Salestaxbouldercoloradogov o llamarnos a 303-441-4425. BOULDER COUNTY SALES TAX TAX DISTRICT RATES Boulder County collects sales tax at the rate of 0985 on all retail transacons in addion to any applicable city and state taxes. Boulder County CO Sales Tax Rate.

DR 0100 - Learn how to fill out the Retail Sales Tax Return DR 0100. The effort is meant to. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state sales tax.

RVs and Motor Homes. Motor Vehicles 1 Revised November 2021 Motor vehicles are tangible personal property and are therefore subject to Colorado sales and use taxes. How to Calculate Colorado Sales Tax on a Car.

The buyer must also possess proof of insurance as required by statute. Recently Purchased Vehicles Boulder County Colorado has a 29 sales tax and Boulder County collects an additional 0985 so the minimum sales tax rate in Boulder County is 3885 not including any city or special district taxes. Vehicle they sell in Colorado and prepare a.

Multiply the vehicle price after trade-ins but before incentives by the sales tax fee. The Boulder sales tax rate is. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions.

For tax rates in other cities see Colorado sales taxes by city and county. The current total local sales tax rate in Boulder County CO is 4985. The December 2020 total local.

Most services are available online. This is the estimated. The maximum tax that can be owed is 525 dollars.

2022 City of Boulder. There is no provision for any po rtion to be retained as a vendor fee. Sales DR 0024 to document the collection of tax.

303-413-7725 Boulder office Fax. The minimum combined 2022 sales tax rate for Boulder Colorado is. Any retail sale that is made in Boulder County is subject to county taxaon.

Colorado law requires motor homes and RVs to be titled and registered the same way as other motor vehicles. About City of Boulders Sales and Use Tax. This is the total of state county and city sales tax rates.

To find out your auto sales tax take the sales price of your vehicle and calculate 772 percent of this price. Standard Sales Tax Receipt for Vehicle. 8 hours agoMay 11Boulder is preparing an ordinance that would exempt products that do not contain nicotine or tobacco from the citys 40 sales tax on electronic smoking devices.

This receipt must also. Background - Understand the importance of properly completing the DR 0024 form. Please note that we do not handle drivers license services.

Boulder county sales tax RTD and SCFD sales taxes. The buyer possesses in the vehicle a Bill of Sale that shows the time date of sale and that is signed by both the seller and buyer. To collect sales tax on the purchase price of each motor.

DR 0800 - Use the DR 0800 to look up local jurisdiction codes. Boulder Countys tax rate is 0985. Trying to decode the Boulder county motor vehicle fees and taxes and the Colorado DMV website.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. Sales Tax for Vehicle Sales DR 0024 Form After completing this course you will be able to do the following. Boulder County does not issue licenses for sales tax as it is collected by the.

Boulder County does not have a sales tax licensing requirement as our sales tax is collected by the Colorado Department of Revenue. If you buy a new car in Boulder is it taxed at the whopping 8845 rate including Boulder city tax. You can print a 8845 sales tax table here.

The minimum is 29. 13 rows Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax. Taxes and Fees are likely to cost more due to the heavier weight of these vehicles.

The vehicle is being driven from the place where the seller stored the vehicle to the place where the buyer intends to store the vehicle. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. Although the taxes charged vary according to location the taxes include Colorado state tax RTD tax and city tax.

However special rules apply to the taxation of motor. For example imagine you are purchasing a vehicle for 50000 with the state sales tax of 29. Vehicle Fee Vehicle Fee Motorcycle 490 Motorcycle 1300.

Sale Use Tax Topics. The Colorado sales tax rate is currently. We also have three office locations throughout the.

The County sales tax rate is. To cite an example the total sales tax charged for residents of Denver amounts to 772 percent. The Boulder County Motor Vehicle Division is the branch of the Clerk and Recorders office that certifies motor vehicle titles and registrations and acts as a division of the Colorado State Department of Revenue.

303-413-7002 Lafayette office Fax. Colorado collects a 29 state sales tax rate on the purchase of all vehicles. Para asistencia en español favor de mandarnos un email a.

Used Cars And Suvs Denver Co Lakewood Co Boulder Cars For Sale

Ford Dealership Fort Collins Interstate Ford

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Longmont Man 22 Killed In Car Crash At 63rd And Oxford In Boulder County The Denver Post

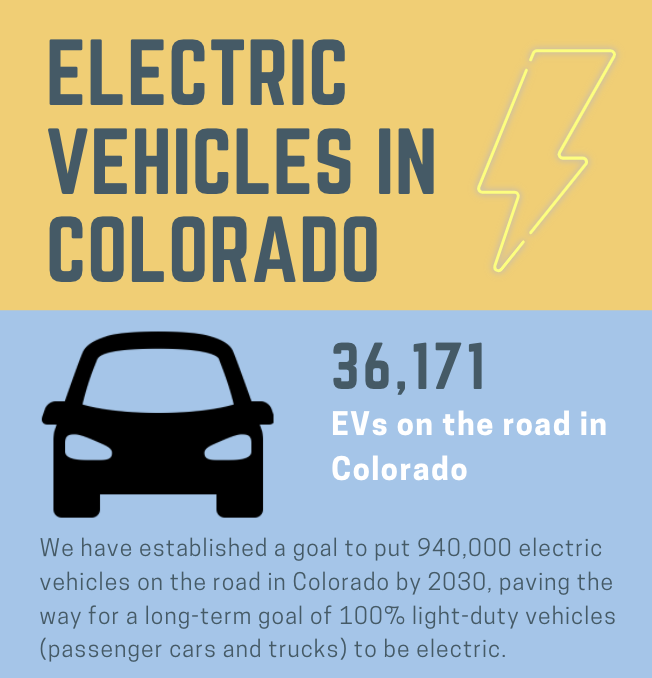

Co Op Program Will Rate Educate Car Dealers About Evs

93 Used Cars In Stock Boulder Denver Fisher Auto

2021 New Vehicle Sales In State Rise 10 Over Year Prior Loveland Reporter Herald

New 2022 Lincoln Vehicles For Sale In Broomfield Co

Chevy Colorado Bed Rack Egr 2 Fender Flares 2015 2016 Colorado Chevy Colorado Gmc Chevy Colorado Chevy Colorado Z71 2015 Chevy Colorado

Recently Purchased Vehicles Boulder County

Recently Purchased Vehicles Boulder County

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

2022 Subaru Ascent Vs 2022 Hyundai Palisade In Boulder Co

34 Boulder View Ln Boulder Co 8 Beds 9 Baths Mansions House Luxury Homes